2018 has begun. Does your accounting to-do list look like a clean slate, or are critical 2017 tasks still nagging?

Getting all of your accounting tasks done in December is always a challenge. Besides the vacation time you and your employees probably took for the holidays, there are those year-end, Let’s-wrap-it-up-by-December-31 projects.

How did you do last month? Were you ready to move forward when you got back to the office in January? Or did you run out of time and have to leave some accounting chores undone?

Besides paying bills and chasing payments, submitting taxes and counting inventory in December, there’s another item that should have been on your to-do list: creating end-of-year reports. If you didn’t get this done, it’s not too late. It’s important to have this information as you begin the New Year. QuickBooks can provide it.

A Report Dashboard

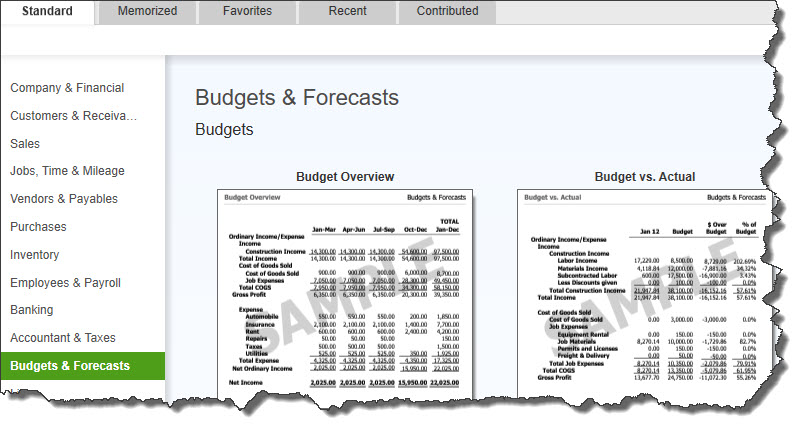

You may be using the Reports menu to access the pre-built frameworks that QuickBooks offers. Have you ever explored the Report Center, though? You can get there by clicking Reports in the navigation toolbar or Reports | Report Center on the drop-down menu at the top of the screen.

QuickBooks’ Report Center introduces you to all of the software’s report templates and helps you access them quickly.

As you can see in the image above, the Report Center divides QuickBooks’ reports into categories and displays samples of each. Click on one of the tabs at the top if you want to:

- Memorize a report using any customization you applied.

- Designate a report as a Favorite.

- See a list of the most Recent reports you ran.

- Explore reports beyond those included with QuickBooks, Contributed by Intuit or other parties.

Recommended Reports

Here are the reports we think you should run as soon as possible if you didn’t have a chance to in December:

Budget vs Actual

We hope that by now you’ve at least started to create a budget for 2018. If not, the best way to begin is by looking at how close you came to your numbers in 2017. QuickBooks actually offers four budget-related reports, but Budget vs Actual is the most important; it tells you how your actual income and expenses compare to what was budgeted.

Budget Overview is just what it sounds like: a comprehensive accounting of your budget for a given period. Profit & Loss Budget Performance is similar to Budget vs Actual. It compares actual to budget amounts for the month, fiscal year-to-date, and annual. Budget vs Actual Graph provides a visual representation of your income and expenses, giving you a quick look at whether you were over or under budget during specific periods.

Income & Expense Graph

You’ve probably been watching your income and expenses all year in one way or another. But you need to look at the whole year in total to see where you stand. This graph shows you both how income compares to expenses and what the largest sources of each are. It doesn’t have the wealth of customization options that other reports due, but you can view it by date, account, customer, and class.

A/R Aging Detail

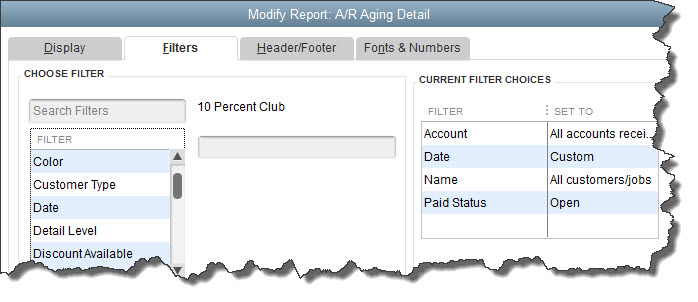

QuickBooks’ report templates offer generous customization options.

Which customers still owe you money from 2017? How much? How far past the due date are they? This is a report you should be running frequently throughout the year. Right now, though, you want to clean up all of the open invoices from 2017. A/R Aging Detail will show you who is current and who is 31-60, 61-90, and 91+ days old. You might consider sending Statements to those customers who are way past due.

A/P Aging Detail

Are you current on all of your bills? If so, this report will tell you so. If some bills slipped through the cracks in December, contact your vendors to let them know you’re on it.

Sales by Item Detail

January is a good time to take a good look at what sold and what didn’t in 2017 before you start placing orders for 2018. We hope you’re watching this closely throughout the year, but looking at monthly and annual totals will help you identify trends – as well as winners and losers.

QuickBooks offers some reports in the Company & Financial and Accountant & Taxes categories that you can create, but which really require expert analysis. These include Balance Sheet, Trial Balance, and Statement of Cash Flows. You need the insight they can offer on at least a quarterly basis, if not monthly. Connect with us, and we can set up a schedule for looking at these.

Social media posts

January is a good time to run reports you didn’t have time to in December. Talk to us about which are most important.

QuickBooks provides templates for some reports that you probably need help analyzing, like Balance Sheet. We can help with these.

Have you explored QuickBooks’ Report Center? It offers a variety of tools and guidance for managing reports.

Did you create a budget for 2017? Now’s the time to run QuickBooks’ Budget vs Actual report.