How to Clean Up QuickBooks for 2020

We know December is a busy month. However, take some time now to make sure QuickBooks is ready for 2020.

Yes, it’s here again: the end of the year. You probably have a lengthy to-do list full of tasks that must be done before December 31. There’s one task—or rather, a series of tasks—that you should definitely add to that list: year-end QuickBooks cleanup. Following the guidelines provided here will do three things. It will:

- Ensure that you’ve processed every 2019 transaction (or that you know why you can’t).

- Give you a sense of closure, knowing that you’ve dealt with all your 2019 financial data.

- Allow you to start your 2020 QuickBooks activities with as clean of a slate as possible.

First Things First

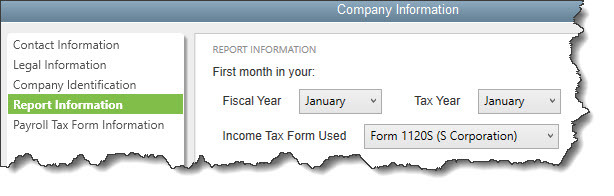

Before you start looking at transactions and running reports, check to make sure that your fiscal year is recorded correctly in QuickBooks. Open the Company menu and select My Company. Click the pencil icon in the upper right to open the Company Information window, then click Report Information in the tabs to the left. This window opens:

Is your company’s fiscal year recorded correctly in QuickBooks? If not, please contact us. Don’t try to fix this on your own.

Account For All Of Your Income

You certainly want to have received all the money owed to you by December 31 if at all possible. So, run a report to see which customers have outstanding, overdue balances. Open the Reports menu and select Customers & Receivables | A/R Aging Summary.

The first column here will read Current. You don’t have to worry about these customers. It’s the next four columns that will require follow-up. If your default payment terms are 30 days, you’ll see columns for 1-30, 31-60, 61-90, and >90. Customers with dollar amounts in those columns have not met their obligations and are past due by those date ranges.

Note: If your default terms are different (like 15 days), you’ll need to customize the report. In the toolbar at the top, you’ll see a field labeled Interval (days). Change it to reflect your own default terms and click Refresh in the upper right corner.

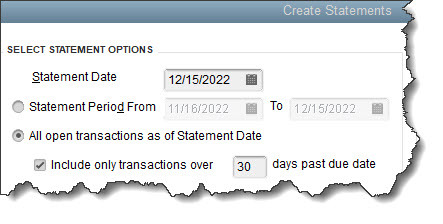

If your report contains only a sea of zeroes in those four columns, everyone is paid up. If not, you can send statements to anyone who is at least one day past due to remind them of what they owe. Open the Customers menu and select Create Statements to see this window:

Partial view of the Create Statements window

Make sure

the Statement Date is correct since

QuickBooks will use this to calculate aging. Then you can either enter a

specific Statement Period or request

All open transactions as of Statement

Date. If you choose the latter, you’ll most likely want to limit the

statements to customers whose payments are overdue. So, you’d click in the box

in front of Include only transactions

over Below

these options, you’ll be able to indicate which customers should receive

statements. The most common choice is All

Customers (who fall into the group you just defined), but you can also send

to one or multiple customers, for example. QuickBooks will display a list if

you select one of these. The right pane of this window contains several

additional options that you can check or uncheck. When you’re satisfied, you

can Preview, Print, or E-mail the

statements. Pay Outstanding Bills You

should also try to settle your Accounts

Payable before the end of the year. Open the Reports menu and select Vendors

& Payables | A/P Aging Summary. Look for dollar amounts in the columns that

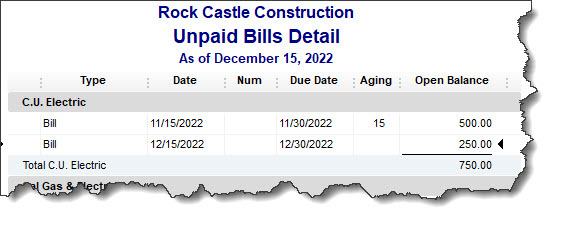

show aging beyond the first column. You can also run the Unpaid Bills Detail report and look at the Aging column, as pictured here: Look

in the aging column of this report to see which bills are past due and by how

many days. Note:

QuickBooks has multiple Preferences that

relate to reports and aging. We can go over these with you if you haven’t

explored them. There are

other tasks you should complete before December 31, some of which may require

our assistance. These include reconciling all accounts, running year-end

reports, and clearing any deposits that remain in the Undeposited Funds account. We’re here if you need us now, otherwise

we can connect in the New Year.