7 Best Practices for QuickBooks

Here are seven ways you can make the most of your QuickBooks experience and improve your productivity and accuracy.

Every profession has its own set of best practices. These are simply guidelines for how employees should be doing their jobs and what steps management should take to ensure the best outcomes. They’re not set in stone. In fact, they can vary from business to business, and they tend to change over the years as technology evolves and individual industries are faced with new challenges and regulations.

The accounting profession is supposed to be compliant with Generally Accepted Accounting Procedures (GAAP). Public companies must comply with them, and many other businesses follow them because they’re simply the most effective way to operate.

QuickBooks follows GAAP rules, but we’re not going to discuss them this month. Rather, we’d like to talk about seven guidelines that can help make your accounting work more accurate, comprehensive, and safe–and inline with what other successful small businesses do.

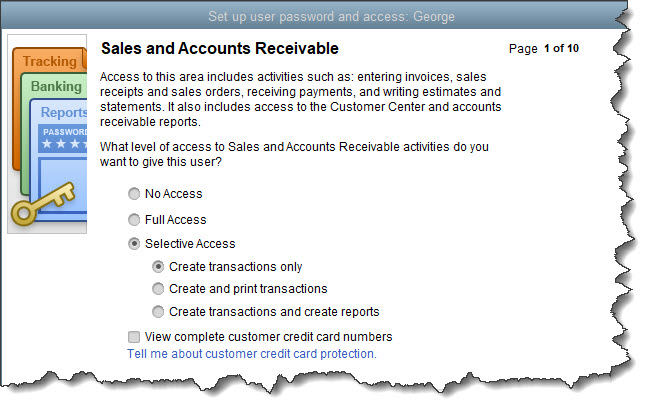

Assign user permissions if multiple people will access QuickBooks. If you’re the only person using QuickBooks, you should still take security seriously by following the usual steps, like creating a strong password and keeping Windows and QuickBooks updated. The safety of your data becomes doubly important when you grant access to someone else. Don’t just give them your login details. Restrict them to specific areas and tasks in the software.

Open the Company menu and click Set Up Users and Passwords, then Set Up Users. In the window that opens, click Add User. Enter a User Name and Password for the individual. If you’re not sure whether your version on QuickBooks has enough licenses, click F2 and look in the upper left corner of the window. Click Next and continue to follow the instructions in the wizard. Questions? Please don’t hesitate to ask us.

Run three reports on a weekly basis

If you’re not running reports regularly, it’s time to start. At minimum, you should be creating three reports in QuickBooks on a regular basis. Open the Reports menu and go to each of these:

- A/R Aging Detail (Customers & Receivables) See who owes you and who is overdue. You can also look at Open Invoices.

- A/P Aging Detail (Vendors & Payables) See who you owe, and whether any payments are due. For a quicker look, see Unpaid Bills Detail.

- Profit & Loss Standard (Company & Financial) Is your income greater than your expenses? Are you making a profit?

Have standard financial reports analyzed regularly

There are several reports that you could run in QuickBooks, like Balance Sheet and Statement of Cash Flows, that are difficult for non-accountants to analyze. But they’re critical to your understanding of your company’s financial health and its future. You also need them if you apply for financing or are looking for investors. We can prepare these for you on a monthly or quarterly basis.

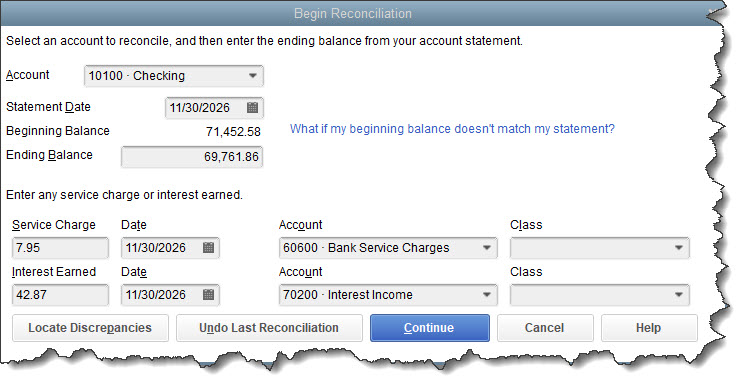

Reconcile your accounts

We know how you dread doing this, but it’s really, really important. QuickBooks simplifies it some, but you may still need our assistance. Reconciling your accounts can help you:

● Learn more about your cash flow,

● Make your reports more accurate, and

● Discover errors and missing transactions.

Make a manual

What happens if you’re the only one doing your company’s accounting and you have to be out for an extended period of time? This could cause serious problems for your business. So when you have a few minutes here and there, start writing down exactly what you do every day and week and month in terms of accounting. This will also be helpful if you take on someone to handle accounting, freeing you up to focus on other management tasks that no one else can do.

Send invoices immediately (and other ways to get customers to pay faster)

Don’t let customers forget about their purchases. Dispatch their bills as soon as you can. We’ve discussed this before, but make them as professional-looking as possible using QuickBooks’ form customization tools. If they’re not paying fast enough, send them a QuickBooks Statement (Customers | Create Statements). Consider accepting credit/debit cards and bank payments by signing up for QuickBooks Payments. You might also want to start adding finance charges to late payments, but be sure to notify customers in writing ahead of time.

Narrow down your reports and use Classes

Your QuickBooks company file consists of hundreds or thousands of records and transactions. And sometimes you only want to see a subset of them, like all customers in a specific ZIP code or all individuals and vendors that have balances over a certain dollar amount. You can do this by customizing QuickBooks reports. Open the report you want, like Customer Contact List, and click Customize Report in the upper left. Click the Filter tab to locate the search field you want.

You can also assign Classes to transactions to isolate related invoices, for example. These can be things like New Construction and Remodel. Open the Lists menu and click Class List to create them.